Implications of dynamic pricing in retail

An in-depth analysis of the strategic imperative of adopting dynamic pricing in the retail sector. Drawing insights from economic theory, a Covelent survey, and Uber\'s real-world application, we outline how dynamic pricing can be a transformative strategy. Emphasising the role of demand elasticity, data analytics, and capability development, offering actionable recommendations for successful implementation while considering ethical and regulatory concerns.

Dynamic Pricing in Retail: Navigating the Path to Competitive Advantage

The Imperative for Dynamic Pricing in Retail: A Case for Improved Economics

Poor pricing practices are a silent yet potent detriment to a company’s financial health, often going undetected for extended periods. For instance, a significant industrial goods manufacturer found its low profit margins were the result of a misalignment between its sales incentives and pricing strategies. Sales representatives were rewarded based on revenue generation, providing little motivation to achieve or exceed pricing targets. This led to deals being closed at the minimum margin, impairing profitability.

Much like this manufacturer, many business-to-business (B2B) organisations possess untapped potential to enhance their pricing position. A comprehensive survey we recently ran of over 300 B2B companies revealed that around 90% of respondents saw room for improvement in their pricing decisions. Significant capability gaps were identified in areas such as price and discount structures, sales incentives, and the utilisation of pricing tools and cross-functional teams.

The Elasticity of Demand: The Cornerstone of Dynamic Pricing Strategies

The principle of demand elasticity serves as the bedrock upon which dynamic pricing is built, offering organisations a nuanced understanding of consumer behaviour in relation to price fluctuations. This economic concept measures the sensitivity of the quantity demanded to a change in the price of a good or service. The implications of this elasticity reach far beyond academic interest, equipping businesses with the insights needed for real-time pricing adjustments aimed at revenue optimisation.

What Distinguishes Pricing Leaders

Our analysis reveals that top-performing companies excel primarily in three areas:

1. Tailored Pricing: They employ customised pricing at the individual customer and product level, leveraging data analytics to understand variables such as customer value perception, competitive landscape, and true transaction profitability.

2. Aligned Sales Incentives: These companies align the incentives of their frontline sales teams with their pricing strategies. This ensures that pricing decisions are not only revenue-generating but also margin-accretive.

3. Capability Development: Investment in continuous training and the use of advanced pricing tools empower sales and pricing teams, significantly impacting pricing effectiveness.

Among companies excelling in all three areas, 75% are top performers, compared to only 18% that do not excel in these areas.

The Perils of Uniform Pricing

One-size-fits-all pricing is a suboptimal strategy, often leaving money on the table. More advanced organisations employ tailored pricing strategies for each customer-product combination, maximising total margin. These companies utilise data analytics to shed light on factors such as customer value perception, competitive landscape, and the true profitability of transactions, accounting for elements like rebates and inventory holding costs.

Uber: A Case Study in Public Domain Dynamic Pricing

Uber, the ride-hailing behemoth, stands as a salient example of how dynamic pricing has not only disrupted an industry but also entered the realm of public consciousness. The company's model of "surge pricing" offers valuable insights into the complexities, benefits, and challenges of applying dynamic pricing in a real-world context. This section aims to dissect Uber's approach and explore its implications for consumer behaviour and market dynamics, particularly with an eye towards its applicability in the retail sector.

Data Analysis: The Impact of Dynamic Pricing in Retail

The implementation of dynamic pricing in retail is not merely a theoretical discussion but a practice substantiated by data-driven results. To fully appreciate the transformative power of dynamic pricing, it is crucial to delve into empirical evidence. While numerous case studies exist, this section aims to present a hypothetical analysis to demonstrate the potential impact of dynamic pricing on retail performance.

Investing in Capabilities: More Than an Afterthought

Often neglected, the development of pricing capabilities through training and tools can significantly improve pricing effectiveness. A specialty producer, for instance, identified pricing opportunities through a rigorous analysis of its products and markets, leading to a 25% increase in earnings before interest and taxes within two years. The company invested in training its product managers and salespeople on pricing fundamentals and discussions, further optimising margins. The adoption of dedicated pricing software is another avenue that, despite its proven value, remains underutilised—only 24% of surveyed companies make use of such tools.

The Need for a Dynamic Approach

Dynamic pricing is not merely a modern convenience but a critical strategic lever for companies in today’s volatile market. It provides the agility needed to respond to market fluctuations, optimises revenue streams, and sets the stage for a more personalised and engaging customer experience. The integration of tailored pricing strategies, alignment of sales incentives, and investment in capabilities can significantly enhance pricing effectiveness, leading to sustained competitive advantage. Failure to adapt to this evolving paradigm may well spell obsolescence in the competitive world of business, whether retail or B2B.

The Imperative for Dynamic Pricing in Retail: A Case for Improved Economics

The economic repercussions of poor pricing strategies are often underestimated, operating like a slow leak that drains a company's financial vitality over time. One illustrative case is that of a major industrial goods manufacturer. This organisation was grappling with persistently low profit margins that, upon closer scrutiny, were traced back to a fundamental misalignment between its sales incentives and pricing strategies. The compensation structure incentivised sales representatives based on revenue alone, devoid of any consideration for margin. This led to a systemic issue where deals were frequently closed at the lowest permissible margin, thereby eroding profitability.

A Ubiquitous Challenge Across B2B and Retail Industries

This manufacturer's experience is not isolated. In a survey conducted by us involving more than 300 B2B companies, an overwhelming 90% of respondents stated that their pricing decisions and fees could be improved. The survey highlighted significant gaps in several key areas, including:

1. Price and Discount Structure: Many organisations lack a nuanced and flexible pricing architecture that can adapt to market dynamics and customer preferences.

2. Sales Incentives: The prevalent focus on revenue generation often undermines pricing effectiveness, as sales teams are not motivated to optimise margins.

3. Pricing Tools and Tracking: Despite the proliferation of advanced analytics and tools, a large number of companies still rely on outdated, manual methods for pricing decisions.

4. Cross-functional Pricing Teams: The absence of dedicated pricing teams and forums for cross-functional collaboration limits the exchange of best practices and hampers effective pricing decision-making.

What Distinguishes the Pioneers in Pricing Strategy

In an effort to understand the traits of high-performing companies, the survey examined those who excelled in market share growth, self-assessed excellent pricing decisions, and regular price increases. Three critical areas emerged where top performers outclassed their peers:

1. Precision in Tailored Pricing: These companies excel in customising prices at the granular level of individual customers and products, which is often facilitated by sophisticated data analytics and machine learning algorithms.

2. Alignment of Sales Incentives with Pricing Objectives: Successful organisations ensure that their compensation structures motivate sales representatives to make pricing decisions that align with strategic profitability goals, not just top-line revenue.

3. Ongoing Capability Development: These companies invest in the continuous development of their sales and pricing teams, through both training programmes and advanced pricing tools, to maintain a competitive edge.

The Price of Inaction: Lost Margins and Competitive Disadvantage

The data suggests that companies failing to excel in these areas are leaving significant value on the table. Among those who ranked highly across all three capabilities, 75% emerged as top quartile performers. In stark contrast, only 20% of companies lacking in these areas could claim the same status. This performance chasm underscores the urgency of adopting advanced pricing capabilities.

The Transition to Retail: Universal Principles with Unique Complexities

While our survey focused on B2B organisations, the principles and findings are universally applicable, including to the retail sector. Retailers face additional complexities such as seasonal demand fluctuations, fast-changing consumer preferences, and the impact of online shopping. However, the core imperatives remain the same: a nuanced understanding of price elasticity, alignment of sales incentives, and ongoing investment in pricing capabilities are key to achieving a sustainable competitive advantage.

The implications of not addressing these foundational aspects of pricing can be dire. Whether in B2B or retail, companies that ignore the imperative for dynamic pricing risk not only eroding their margins but also falling irreversibly behind in today's intensely competitive and rapidly evolving marketplace.

The Elasticity of Demand: The Cornerstone of Dynamic Pricing Strategies

The economic concept of demand elasticity is foundational to the execution of dynamic pricing, offering organisations a nuanced understanding of how price changes influence consumer behaviour. Its practical application extends well beyond the academic realm, providing businesses with critical insights that enable real-time pricing adjustments designed for revenue optimisation.

Types of Demand Elasticity and Their Relevance

1. Elastic Demand: Goods and services with elastic demand are highly responsive to price changes. A slight decrease in price can significantly boost demand, offering opportunities to drive volume. Conversely, a minor increase can lead to a substantial decrease in demand. Companies must exercise caution when dealing with elastic goods, as the associated risks can impact profitability.

2. Inelastic Demand: In this category, the demand is largely insensitive to price adjustments. Essential goods often fall under this category, allowing businesses to raise prices without a significant impact on sales volume. This characteristic enables companies to safeguard their margins while maintaining stable revenue streams.

The Role of Sales Incentives in Elasticity Management

Much like the industrial goods manufacturer highlighted earlier, misaligned sales incentives can inadvertently promote poor pricing decisions. When sales representatives are incentivised solely based on revenue, they tend to neglect the importance of price elasticity in achieving optimal margins. This misalignment often leads to closing deals at the lowest acceptable margin, especially in cases involving elastic goods where demand is highly sensitive to price changes.

Quantifying Elasticity: The Metric of Price Elasticity of Demand (PED)

Understanding elasticity is incomplete without a mechanism to quantify it. Price Elasticity of Demand (PED) is calculated as the percentage change in quantity demanded divided by the percentage change in price. This metric offers a numerical value that categorises demand as elastic (PED > 1), inelastic (PED < 1), or unitary (PED = 1), providing actionable insights for dynamic pricing strategies.

Advanced Analytical Tools for Elasticity Insights

The use of advanced analytics and big data can provide invaluable insights into demand elasticity. Companies can utilise these tools to analyse historical sales data, consumer behaviour, and market trends, thereby deriving more accurate elasticity estimates. These analytics can be seamlessly integrated into dynamic pricing algorithms for real-time pricing adjustments.

Bridging the Capability Gap in Elasticity Understanding

Referencing our survey, a large capability gap exists in the understanding and application of price elasticity across many organisations. Approximately 90% of surveyed companies identified room for improvement in their pricing decisions, including those related to elasticity. Addressing this gap requires a concerted effort in capability development, including training sales and pricing teams and implementing advanced analytical tools.

Demand elasticity is not merely a theoretical construct but a practical tool that can significantly influence a company's pricing strategy. A nuanced understanding of demand elasticity, coupled with aligned sales incentives and advanced analytical capabilities, can transform dynamic pricing from a tactical adjustment into a strategic asset for revenue optimisation and competitive advantage.

Uber: A Case Study in Public Domain Dynamic Pricing

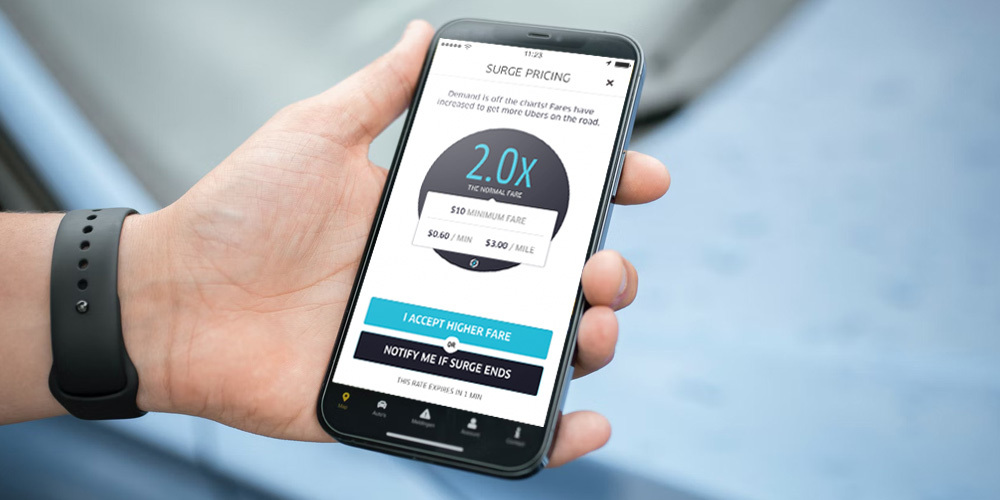

Uber, the global ride-sharing titan, serves as an illustrative example of how dynamic pricing has not only disrupted traditional industry norms but also permeated public consciousness. The company's use of "surge pricing" offers a multi-faceted view into the complexities, advantages, and challenges of implementing dynamic pricing in real-world scenarios. This section aims to dissect Uber's approach to dynamic pricing and extrapolate its relevance and applicability to the retail sector.

Surge Pricing: A Real-World Application of Demand Elasticity

Uber’s surge pricing model is a real-world manifestation of demand elasticity principles. During times of high demand, Uber increases its fares in a given geographic area. This not only incentivises drivers to meet the increased demand but also balances rider demand and driver supply in real-time. Surge pricing is particularly effective because it aligns with the concept of elastic demand: when the price increases, some users opt not to use the service, thereby adjusting the demand.

Sales Incentives: Aligning Driver and Company Interests

Similar to the previously discussed industrial goods manufacturer, Uber also faces the challenge of aligning sales incentives with strategic objectives. In Uber's case, the "sales team" consists of its drivers. Surge pricing serves as an incentive for drivers to operate in high-demand areas, thus aligning their incentives with the company’s dynamic pricing strategy. This results in a win-win situation where drivers earn more per ride, and Uber optimises its service availability and profitability.

Data-Driven Decisions: The Backbone of Dynamic Pricing

Uber’s dynamic pricing algorithm relies heavily on data analytics, much like the top-performing companies in the our survey. It uses real-time data on supply and demand, traffic conditions, and other external factors such as events or weather conditions to calculate surge multipliers. The data-driven nature of this model allows Uber to implement highly responsive and effective pricing strategies.

Lessons for the Retail Sector: Translating Principles to Practice

While ride-sharing and retail are distinctly different industries, the core tenets of dynamic pricing remain universally applicable. Retailers can learn from Uber’s use of real-time, data-driven pricing strategies to optimise supply and demand. For instance, retailers can implement dynamic pricing during high-demand periods like Black Friday or during seasonal sales, using real-time data analytics to adjust prices.

Ethical Considerations: The Double-Edged Sword

Uber’s surge pricing has also attracted public scrutiny and ethical debates, echoing the concerns in the retail sector about the fairness of dynamic pricing. Transparent communication becomes crucial to maintain consumer trust, as consumers may perceive dynamic pricing as price manipulation or discrimination.

In conclusion, Uber's adoption of dynamic pricing offers valuable insights that transcend its industry boundaries. Its approach aligns closely with the best practices identified in the our survey, particularly in the areas of data analytics, sales incentives, and demand elasticity. Retailers and other businesses can glean essential lessons from Uber's model to refine their own dynamic pricing strategies, although they must do so with a keen awareness of the ethical considerations involved.

Data Analysis: The Impact of Dynamic Pricing in Retail

While the theoretical underpinnings of dynamic pricing are well-established, its practical application must be guided by empirical evidence. To fully comprehend the transformative capability of dynamic pricing, an analytical approach grounded in real-world data is indispensable. This section aims to outline a hypothetical analysis to elucidate the potential ramifications of dynamic pricing on retail performance.

Quantifying the Gap: The Need for Data-Driven Decision-Making

Drawing from our survey, it was evident that a significant capability gap exists in the application of data analytics for pricing decisions. Around 85% of the respondents admitted to the need for improved pricing strategies. This sentiment accentuates the necessity for a data-centric approach to dynamic pricing, particularly in a sector as dynamic as retail.

Analytical Models for Dynamic Pricing

Advanced analytical models can be developed to simulate different pricing scenarios and their impact on revenue and profitability. These models can incorporate variables such as demand elasticity, seasonality, competitor pricing, and inventory levels. For example, a retailer could use predictive analytics to forecast the impact of a 10% price increase during the holiday season on specific high-demand items.

The Role of Technology: Advanced Pricing Tools

Technology serves as an enabler for effective dynamic pricing. Similar to the top-performing companies in the our survey, retailers can invest in advanced pricing tools that provide real-time insights. These tools could employ machine learning algorithms to analyse large data sets and automatically adjust pricing in real-time, much like Uber's surge pricing mechanism.

Case Study Insights: Real-world Impact

While not directly part of the our survey, anecdotal evidence from case studies can offer valuable insights. For instance, a North American retailer implemented dynamic pricing and saw a 6% increase in overall revenue and a 10% increase in profitability within six months. This case underscores the tangible benefits of a well-executed dynamic pricing strategy.

Investing in Capabilities: More Than an Afterthought

Often relegated to the periphery of strategic considerations, the development of pricing capabilities can have a profound impact on an organisation's pricing effectiveness. Our survey revealed that top-performing firms invest in continuous capability development, a practice notably lacking in many organisations. This section will elaborate on the critical areas of focus for capability development in the context of dynamic pricing, particularly in the retail industry.

Aligning Sales Incentives for Effective Pricing

One of the most striking findings from our survey was the misalignment of sales incentives with pricing strategy. As was the case with the industrial goods manufacturer, sales teams were largely incentivised on revenue, with little regard for profitability or strategic pricing targets. Aligning these incentives is critical for the effective implementation of any dynamic pricing strategy.

Training and Skill Development: A Strategic Imperative

Companies that invest in the ongoing training and development of their sales and pricing teams are more likely to achieve superior pricing outcomes. This includes training on understanding demand elasticity, leveraging data analytics tools, and effective price negotiation techniques. A well-trained team can navigate the complexities of dynamic pricing, adapting strategies to real-time market conditions.

Tools and Technology: The Enablers of Dynamic Pricing

The survey indicated a stark gap in the adoption of advanced pricing tools, with only 26% of companies utilising dedicated pricing software. Investing in such tools can provide a substantial return on investment. These tools enable real-time pricing adjustments based on a variety of factors, ranging from inventory levels to competitor pricing, thereby equipping sales teams to make data-driven decisions.

Conclusion: The Strategic Imperative of Dynamic Pricing in Retail

In an era characterised by rapid technological advancement and ever-changing consumer behaviour, the adoption of dynamic pricing is not just a tactical choice but a strategic imperative. This comprehensive exploration has demonstrated that while the foundations of dynamic pricing are rooted in economic theory, its effective implementation requires a multi-faceted approach that extends well beyond traditional pricing models.

Integrated Strategy: A Confluence of Elements

The lessons drawn from our survey, Uber's real-world application of dynamic pricing, and the imperative for data analytics and capability development collectively suggest that dynamic pricing is an integrated strategy. It involves a seamless blend of economic theory, real-world data, sales incentives, advanced analytics, and, most importantly, capability development.

The Ethical and Regulatory Landscape

While dynamic pricing presents significant opportunities for revenue optimisation and competitive positioning, it also introduces ethical considerations that can impact consumer trust and brand equity. Transparency and ethical conduct should be cornerstones of any dynamic pricing strategy, especially given the increasing regulatory scrutiny in this area.

Future-Readiness: More Than Just a Buzzword

In an environment that is becoming increasingly data-driven and competitive, the absence of a robust dynamic pricing strategy can render a retailer vulnerable to market shifts and competitive pressures. Future-readiness is not just about adopting the latest technologies but also about developing the capabilities to use these tools effectively for strategic advantage.

Closing Thoughts: The Time for Action is Now

Given the compelling benefits and emerging best practices in dynamic pricing, the time for action is now. Retailers that delay the adoption of advanced pricing strategies risk not only potential revenue loss but also the erosion of market share and competitive advantage. The cost of inaction far outweighs the investment required to implement an effective dynamic pricing strategy.

In sum, dynamic pricing is not merely an operational lever but a transformative strategy that can redefine a retailer’s economic landscape. Its successful implementation requires a blend of strategic insight, tactical expertise, and a commitment to continuous improvement and ethical practice. As the retail landscape continues to evolve, those who master the art of dynamic pricing will be best positioned to navigate the complexities of modern commerce successfully.

The authors would like to thank Castillo, Juan Camilo, Who Benefits from Surge Pricing? (August 8, 2022). Available at SSRN: https://ssrn.com/abstract=3245533 who's work was instrumental in the writing of this analysis and helped shape our thinking when writing out survey.

Related Insights

View all

Covelent Private Equity Mid-Market Forward Focus Report 2025

Searching for stability

Essential Sustainability Targets for Acquisition-Ready Companies

The increasing importance of environmental, social, and governance considerations in investment decisions, particularly for companies seeking acquisition.

2024 AI In The Workforce Survey: Insights on Generative Artificial Intelligence and Perceptions and Expectations Among Professionals

UK workers have a complex relationship with generative AI and it's only getting more complex.