Creating An Actionable Capital Allocation Strategy

Capital allocation is a strategic decision-making process that involves the distribution, re-distribution, and investment of a company\'s financial resources to maximise long-term shareholder value. It\'s central to a company\'s success and encompasses a wide range of decisions, from financial investments to human resource management.

What is Capital Allocation Strategy?

Capital allocation is a strategic decision-making process that involves the distribution, re-distribution, and investment of a company's financial resources to maximise long-term shareholder value. It's central to a company's success and encompasses a wide range of decisions, from financial investments to human resource management. CEOs often grapple with critical questions during this process:

- Do we efficiently allocate scarce capital? This question underscores the need to use capital in a way that maximises returns, considering the limited nature of financial resources.

- Do we spend talent and management attention on the most important issues? This highlights the importance of aligning human capital and managerial focus with strategic priorities.

- What kinds of deals should we be pursuing (both acquisitions and divestments)? This involves evaluating potential mergers, acquisitions, and divestitures to determine how they align with the company's growth strategy and overall objectives.

Several business issues often trigger a review of a company’s capital allocation strategy:

- Excess cash or cash shortage requires a revisit of the allocation process: Companies must decide how best to use surplus funds or address shortages, affecting investment and operational strategies.

- Lack of 'return on capital' – performance, EBIT- or revenue-centric organisation: A review is necessary when returns on capital do not meet expectations, indicating potential inefficiencies or misalignments in how resources are deployed.

- Investments directed at large or cash-cow business units: Focusing on how investments are distributed across various business units, especially those that are significant revenue generators, is crucial for balanced growth.

- Performance issues on large investment projects: Challenges in major projects necessitate a reassessment of whether the allocated capital is yielding the desired outcomes.

In the end, capital allocation is about making informed decisions on where to invest resources to steer the company towards sustained profitability and growth. It involves a comprehensive analysis of financial, operational, and strategic factors to ensure that resources are being used in the most effective manner possible.

Why is Capital Allocation Important?

The importance of capital allocation cannot be overstated, as it directly impacts a company's growth, profitability, and shareholder value. Companies with more effective capital allocation strategies often see better financial performance and shareholder returns. This is particularly crucial in competitive markets where the efficient allocation of capital is necessary for survival and growth. Companies must make strategic decisions about investments, ensuring that they exceed the opportunity cost of capital to avoid value erosion.

How to Make Your Capital Allocation Strategy Meaningful

1. Aligning with Corporate Strategy

To create a meaningful capital allocation strategy, it's essential to align it with the corporate strategy, focusing on growth strategy, market & geographic expansion, and introducing new offerings. This involves understanding the strategic attractiveness of a business and the extent to which an investment supports market tailwinds and strengthens competitive advantage.

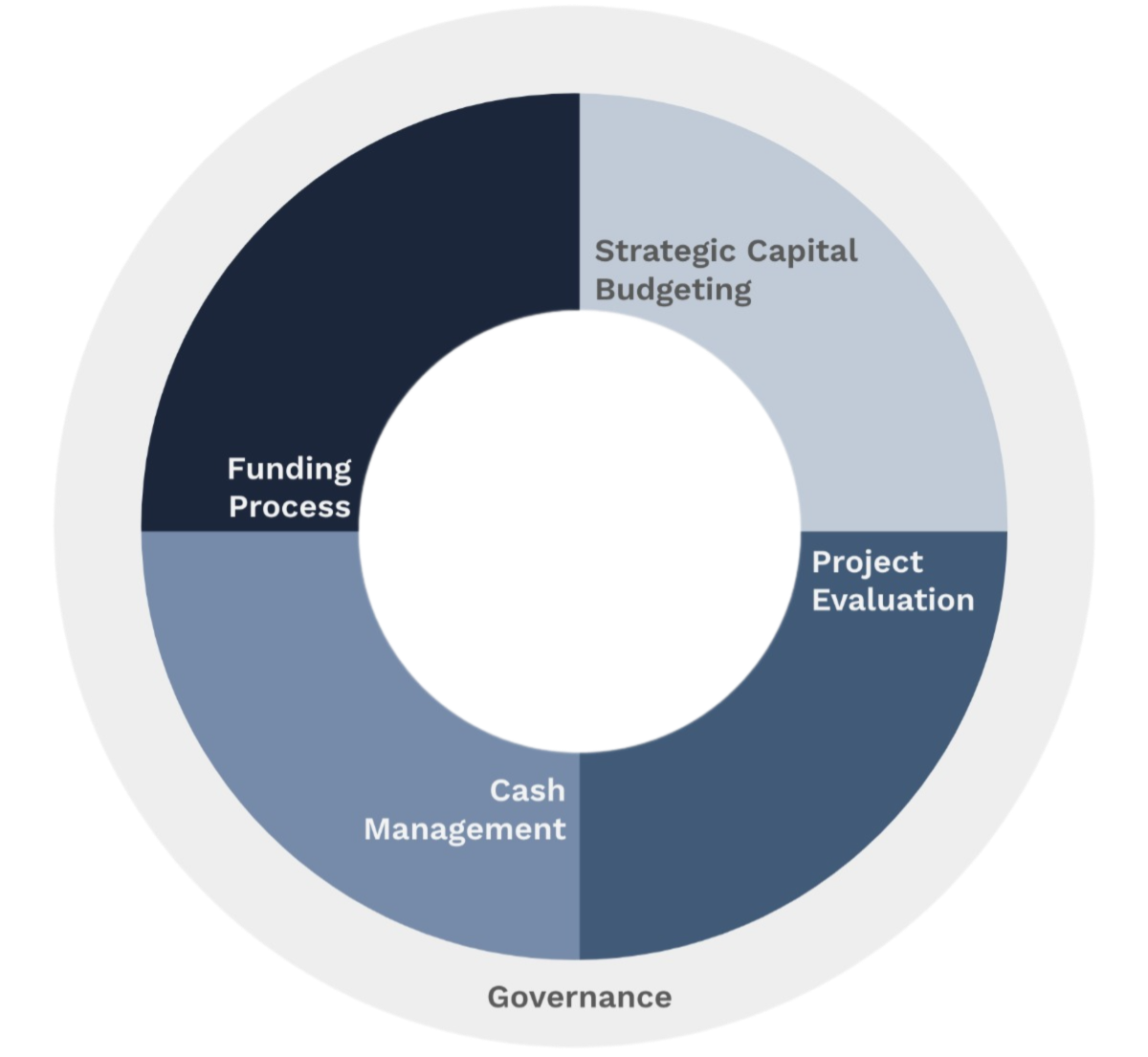

2. Transparency and Governance

The first step in a framework for evaluating capital allocations is to create transparency on the current investment portfolio and funding process. This involves setting up a governance and investment review process according to industry best practices. Such transparency ensures that capital is allocated effectively, avoiding common pitfalls like the maturing-business trap or the egalitarian trap, where every business unit gets its "fair capex share" irrespective of potential.

3. Balancing Investment Portfolio

Analysing the company's investment program from a portfolio perspective ensures that investments are consistent with the company's strategic priorities. This includes categori business units based on their market life cycle stage and allocating capital accordingly, such as limiting capex to mandatory investments for mature businesses, thereby freeing up resources for more promising segments.

4. Strategic Execution

Implementing the capital allocation strategy requires robust decision-making frameworks, such as the DARE model, which stands for deciders, advisers, recommenders, and execution stakeholders. This helps in maintaining the quality of team dynamics and encouraging diverse perspectives to avoid groupthink. CEOs and their teams must strive to invest for growth, shifting from gatekeepers of capital to champions of growth.

5. Evaluating Investment Projects

When funding individual capital projects, companies should go beyond internal rate of return. This involves considering additional criteria like strategic, financial, risk, and resource profiles. For instance, a European industrial conglomerate evaluates investment projects based on explicit criteria summarised in a simple scoring model.

Creating an actionable capital allocation strategy requires a blend of strategic insight, rigorous governance, and a dynamic approach to investment decisions. By focusing on these key areas, companies can ensure that their capital allocation not only supports their current operations but also positions them for future growth and success.

Related Articles

View all

Corporate Vision: Steering Toward Success

A good corporate vision transcends a simple statement to become the heartbeat of the organisation. It articulates in a truly meaningful way, the company's goals, value, and the strategic direction that propels the company forward. By doing so, it aligns the collective efforts of the workforce, ensuring that every action taken is a step towards realising the overall goals. Fostering a sense of purpose and unity among employees, driving the organisation with a shared sense of commitment.

Geographic Expansion: Unlocking Global Markets

Companies that pursue growth often find themselves at a crossroads where the saturation of their current markets poses a significant challenge to their growth ambitions.

Can a Growth Mindset be Taught? Unlocking Growth Strategy

Exploring how organisations can cultivate a growth mindset among employees and integrate it into their overall growth strategy for sustainable success.